Table of Contents

What is a crypto off-ramp?

A crypto off-ramp refers to the process of converting cryptocurrency holdings into traditional fiat currency like dollar and euro or other assets. In simple terms, it’s the exit point from the world of digital currencies back into the traditional financial system. Off-ramping allows crypto investors to realize their gains or use their funds for everyday purchases, investments, or other financial activities. This process typically involves using cryptocurrency exchanges, over-the-counter (OTC) desks, peer-to-peer (P2P) platforms, or other services designed to facilitate the conversion of crypto assets into fiat currency. Understanding how to effectively utilize crypto off-ramps is essential for anyone looking to navigate the crypto space and manage their digital assets.

Key considerations when off-ramping crypto

Off-ramping crypto requires careful consideration of various factors to ensure a seamless and efficient process. From evaluating fees to understanding regulatory requirements, each aspect plays a crucial role in determining the optimal off-ramp strategy. Below, we’ll explore the key considerations you need to keep in mind when off-ramping your cryptocurrency holdings.

- Fees: Evaluate the fees associated with off-ramping your crypto holdings. Different platforms and services may charge varying fees, including transaction fees, withdrawal fees, conversion fees and spread. Understanding the fee structure upfront can help you minimize costs and maximize your returns. The methods discussed in this article span from 0% fees to several percentage points.

- KYC (know your customer) requirements: Many off-ramp services, especially regulated exchanges and financial institutions, require users to complete KYC verification before processing transactions. Be prepared to provide personal identification documents and other information to comply with regulatory requirements. However there are multiple off-ramps available that do not require KYC.

- Maximum off-ramp Limits: Determine the maximum amount of cryptocurrency you can off-ramp in a single transaction or within a specific timeframe. Some platforms impose limits on withdrawal amounts to mitigate risks associated with large transactions. If you’re planning to off-ramp a significant sum, ensure that the platform’s limits align with your needs.

- Security Measures: Prioritize security when choosing off-ramp methods and platforms. Opt for reputable and well-established services with robust security measures

- Speed and Liquidity: Assess the speed and liquidity of the off-ramp service to determine how quickly you can convert your crypto assets into fiat currency or other assets. Some platforms offer instant withdrawals, while others may have longer processing times.

- Ease of Off-Ramp: Consider the convenience of the off-ramping process, including factors such as registration requirements, the need for multiple transactions, and the procedure for linking your bank account or other payment methods.

Best methods to off-ramp crypto

When it comes to transitioning your cryptocurrency holdings into traditional currency or other digital assets, it’s essential to explore the most effective off-ramp options available. These methods not only facilitate seamless transactions but also offer various advantages and considerations to cater to different needs and preferences. Let’s delve into some of the top methods for off-ramping crypto and examine their unique features and benefits.

1. Buying gift cards with crypto

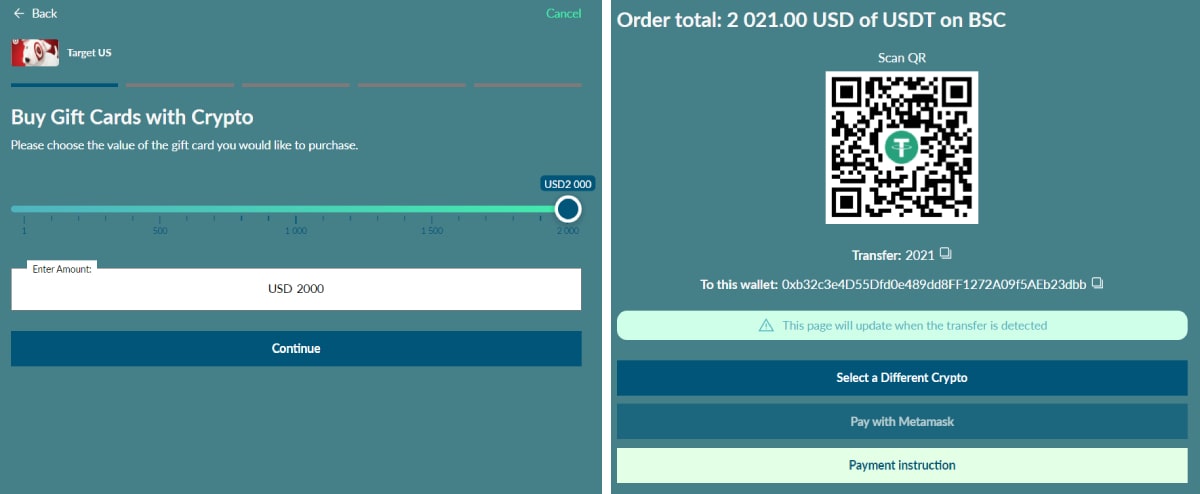

One of the most convenient and versatile methods to off-ramp crypto is by purchasing gift cards. Platforms like Zypto and Coingate facilitate this process, offering users a seamless way to convert their digital assets into gift cards from a wide range of retailers. The beauty of this method lies in its simplicity and speed; it requires no KYC or registration, making it incredibly easy and fast to use. The process typically involves selecting your desired gift card and specifying the fiat amount you want to load onto it. Next, choose the cryptocurrency you wish to pay with and send the specified amount to a designated crypto address. Within minutes, the gift cards are usually delivered by mail, ready to be used for a variety of purchases both online and in-store.

Moreover, the fees associated with buying gift cards with crypto are typically extremely low or close to zero. While both Zypto and Coingate offer competitive rates, Zypto tends to be slightly cheaper. For example, a $2,000 Target gift card would cost approximately $2,021 USDT through Zypto, whereas the same card would cost around $2,038 USDT (reduced from $2,080) through Coingate.

By leveraging platforms like Zypto and Coingate, individuals can easily off-ramp their crypto holdings while gaining access to a plethora of goods and services. Whether you’re shopping online or in-store, buying gift cards with crypto provides flexibility, accessibility, and cost-effectiveness.

Positives

- Low fees (~ 0% - 2%)

- Fund arrive within minutes

- Easy to use (no registration required)

- No KYC required

- Secure off-ramp

Negatives

- Low off-ramp limits of max $2.000

Great crypto gift card platforms

Honorable mention: crypto payment gateways

Crypto payment gateways allow webshop to accept crypto payments and stand out as the best off-ramp option by far, offering unparalleled advantages such as zero fees, instant transactions, ease of use, and enhanced security. However, their full potential has yet to be realized due to low adoption rates among merchants. This sole reason prevents them from claiming the top spot as the best crypto off-ramp and instead positions them as an honorable mention. However, with the increasing acceptance of cryptocurrencies among merchants, crypto payment gateways hold the promise of becoming the premier choice for converting cryptocurrency into goods and services in the future.

Advantages:

- Zero Fees: Users typically incur no fees when using crypto payment gateways, as the merchant absorbs the transaction costs.

- Instant Transactions: Payments made through crypto gateways are processed instantly, providing a seamless and efficient user experience.

- Ease of Use: Utilizing crypto payment gateways requires no registration or KYC verification, simplifying the transaction process.

- Enhanced Security: Transactions conducted through crypto gateways are highly secure, leveraging blockchain technology to ensure transparency and immutability.

Drawbacks:

- Limited Adoption: Despite their numerous advantages, crypto payment gateways are still not widely adopted by merchants. As a result, users may encounter limited opportunities to utilize this off-ramp method.

Positives

- No transaction fees

- Instant off-ramp

- Secure off-ramp

- Easy to transact

Negatives

- Limited adoption

Great crypto payment gateways

We have conducted an extensive review of the best crypto payment gateways, of which the top 4 are shown below.

2. Using crypto debit cards

Crypto debit cards provide a convenient way to off-ramp cryptocurrency while retaining the flexibility of traditional payment methods. These cards come in two varieties: physical and virtual.

Physical Cards:

Physical crypto debit cards typically require a longer processing time to receive and involve more stringent KYC (Know Your Customer) procedures. However, they offer higher maximum spending limits of over $100.000 or even multiple millions. Users may need to provide identification documents and undergo thorough verification processes to obtain physical cards.

Virtual Cards:

On the other hand, virtual crypto debit cards offer quick setup and activation, making them ideal for immediate use. They often come with softer KYC requirements, with some providers not requiring any identification at all. However, virtual cards usually have lower spending limits compared to physical cards, typically ranging from $1,000 to $10,000.

Fees associated with crypto debit cards vary depending on the provider and card type. Common fees include issuance fees, monthly or annual maintenance fees, transaction fees (both domestic and international), ATM withdrawal fees, and currency conversion fees for transactions in foreign currencies. It’s essential to carefully review the fee structure of each card to understand the costs involved before making a decision.

Positives

- Low fees

- Virtual cards are quick to receive

- Secure off-ramp

Negatives

- Crypto debit cards usually have KYC

- Physical cards take long to arrive

Great crypto debit card platforms

3. Crypto exchanges

When it comes to converting cryptocurrency into traditional currency or other digital assets, exchanges are the go-to choice for many investors. They offer a wide variety of trading options and high liquidity, making it easy to make these conversions. However, while exchanges are convenient, there are some important factors to consider that could affect how well they work as an off-ramp for your crypto holdings.

KYC and Registration:

Using exchanges as an off-ramp requires users to undergo a process called KYC (Know Your Customer) verification. This process involves providing personal information and verifying your identity before you can start making transactions. Essentially, it’s like opening a bank account online, where the exchange needs to ensure that you are who you say you are.

Fees:

When it comes to fees, exchanges have a variety of charges that users need to be aware of, which can add up. These fees can include trading fees, which are charged when you buy or sell cryptocurrencies, spread fees, which represent the difference between the buying and selling prices, and fixed withdrawal fees for taking your money out of the exchange. Understanding these fees is crucial because they can add up and impact the overall cost of your transactions.

Withdrawal Times:

Another factor to consider is withdrawal times. After you’ve made a trade and want to take your money out of the exchange, it typically takes between 1 to 5 days for the withdrawal to process and for the funds to reach your bank account or other chosen withdrawal method. However, the exact time can vary depending on factors like the exchange’s processing speed and the method you’ve chosen for withdrawal.

Positives

- High withdrawal limits

- Secure off-ramp (if a trustworthy exchange is chosen)

Negatives

- Takes a long time to off-ramp

- Requires KYC

Great crypto exchange platforms

Conclusion

In conclusion, selecting the best method to off-ramp your cryptocurrency involves careful consideration of various factors such as fees, KYC requirements, maximum limits, security measures, speed, and liquidity. Each off-ramp option comes with its own set of advantages and drawbacks, catering to different preferences and needs within the crypto community.

Gift cards offer convenience and accessibility, allowing users to convert their crypto holdings into a wide range of goods and services. While crypto payment gateways deliver zero fees, instant transactions, and enhanced security, their full potential remains untapped due to low adoption rates among merchants. Crypto debit cards provide a bridge between cryptocurrency and traditional payment methods, offering users the flexibility to spend their crypto holdings while navigating through varying KYC requirements and fees. Exchanges, although widely used, require users to undergo KYC verification and may incur extra fees and longer processing times.

Ultimately, the best method for off-ramping crypto depends on your individual preferences, priorities, and circumstances. As the crypto landscape continues to evolve and mature, it’s essential to stay informed and adapt to emerging off-ramp solutions that align with your needs. By understanding the key considerations and exploring the available options, you can navigate the off-ramp process with confidence and efficiency, unlocking the value of your cryptocurrency holdings in the traditional financial system.

Frequently asked questions

Off-ramping crypto involves converting your cryptocurrency holdings into traditional fiat currency or other assets. You can do this through various methods such as using crypto exchanges, crypto payment gateways, crypto debit cards or purchasing gift cards with crypto. Each method has its own set of advantages and considerations, so it’s essential to evaluate factors like fees, KYC requirements, maximum limits, security measures, speed, and liquidity to determine the most suitable option for your needs.

Off-ramping crypto without undergoing KYC (Know Your Customer) verification is limited to specific methods that prioritize user privacy and anonymity. These include purchasing gift cards with crypto, acquiring virtual debit cards with crypto, or conducting transactions directly with merchants that accept cryptocurrency payments. Platforms such as Zypto (lower fees) and Coingate facilitate these off-ramping methods, offering users the opportunity to convert their digital assets without the need for extensive identity verification processes.

Buying gift cards with crypto is a straightforward process that typically involves the following steps:

- Select a platform that facilitates the purchase of gift cards with cryptocurrency, such as Zypto (lower fees) or Coingate.

- Choose the desired gift card from a wide range of retailers available on the platform.

- Specify the fiat amount you want to load onto the gift card.

- Select the cryptocurrency you wish to pay with and send the specified amount to the designated crypto address provided by the platform.

- Once the transaction is confirmed, the gift card is usually delivered electronically or by mail, ready to be used for online or in-store purchases.

This method offers simplicity, speed, and convenience, with low or zero fees and no KYC requirements, making it an attractive option for off-ramping crypto holdings.