Over 10% discount on all FCF Pay transaction fees

About FCF Pay

FCF Pay is a game-changer within the cryptocurrency industry, known for its innovative approach to making crypto payments easy. Their goal is to simplify the process of accepting cryptocurrencies, and their efforts have been recognized at the Dubai crypto expo, where they won the award for ‘Most Innovative Project of 2022’.

Now, undergoing a significant transformation, FCF Pay is set to rebrand as Zypto – a crypto payment gateway and wallet with numerous advantages, as highlighted in our Zypto review.

FCF Pay delivers an intuitive checkout page, which makes it easy for users to complete transactions. Moreover, it also offers a range of smart functionalities that enhance the overall user experience. In addition to these features, FCF Pay boasts low transaction fees, making it an attractive option for both merchants and customers.

In this full FCF Pay review, we will delve deeper into these features and benefits, as well as any potential drawbacks of using this platform. By providing a comprehensive overview, we aim to help you make an informed decision about whether FCF Pay is the right choice for you.

Overall judgement

FCF Pay Review scores

Transaction fees

Functionalities

Accepted cryptocurrencies

Ease of setup

Customer support

Positives

- Free and easy integration

- Fees as low as 0.5%

- Large amount of smart functionalities like volatility protection

- Over 80 cryptocurrencies are accepted

- Online, offline and an invoicing system

Negatives

- User interface could be improved

- Not a well-known brand

Transaction fees

FCF Pay has some of the lowest transaction fees in the industry. For companies that generate at least €50,000 in crypto transaction volume, the fees are as low as 0.5%. This fee drops to 1% for companies that generate between €10,000 and €50,000, and for those generating less than €10,000, the fees are 1.5%.

These competitive fees make FCF Pay a cost-effective option for businesses of all sizes, from small startups to large enterprises. By choosing FCF Pay, businesses can save money on transaction fees and potentially increase their profits.

Functionalities

FCF Pay offers a range of smart functionalities to help merchants and customers when accepting cryptocurrencies. These features include:

- Smart Swap: a volatility protection system that allows merchants to automatically convert incoming cryptocurrencies to either stablecoins or fiat (USD/EUR), eliminating the impact of volatility on their business.

- A wide selection of off-ramping partners: FCF Pay has partnered with numerous companies to facilitate easy transfers of cryptocurrencies to fiat, giving merchants access to a range of options for cashing out.

- Online and offline crypto payment gateways: FCF Pay offers both an online payment gateway for e-commerce stores and an offline payment gateway for brick-and-mortar businesses, providing flexibility and convenience for all merchants.

- An invoicing system: FCF Pay offers an invoicing system that allows merchants to easily create and send invoices to customers in a range of cryptocurrencies.

- A white-label solution: FCF Pay’s crypto payment gateways can be rebranded as a merchant’s or payment service provider’s (PSP’s) own product, giving businesses the opportunity to customize the look and feel of the payment process.

- A donation widget: FCF Pay’s donation widget makes it easy for merchants to accept crypto donations on their website.

- Crypto credit cards: FCF Pay offers a crypto credit card with minimal KYC requirements and a daily limit of up to $5,000. They also recently announced a higher-limit card with a daily limit of up to $150,000, requiring ID verification.

- White-label crypto credit cards: FCF Pay offers a white-label version of their crypto credit cards to merchants, exchanges, banks, and other partners. This product is currently in beta testing.

Overall, FCF Pay’s smart functionalities provide a range of benefits for merchants and customers, making it a top choice for accepting cryptocurrencies.

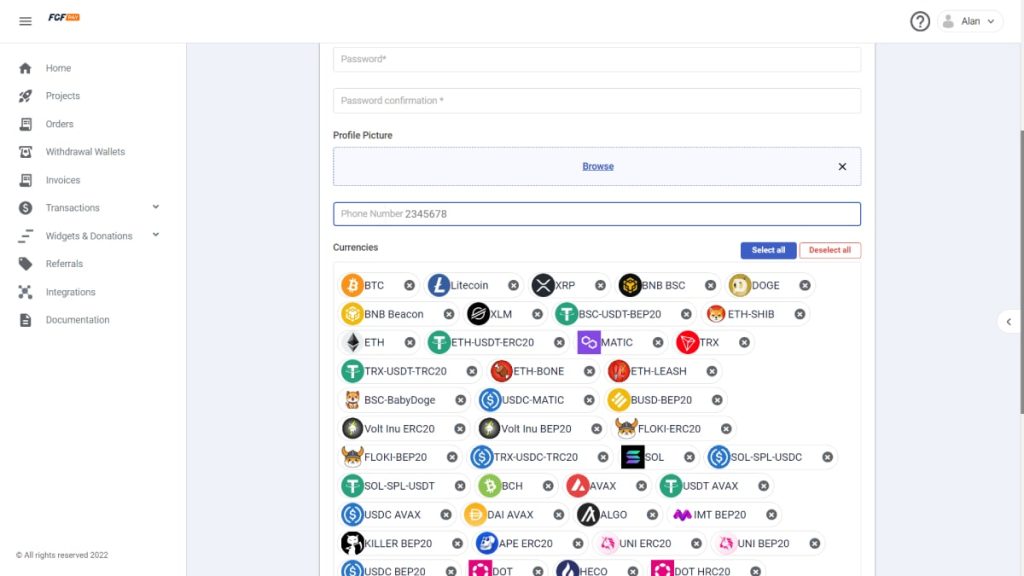

Accepted cryptocurrencies

FCF Pay allows merchants to choose from a wide selection of cryptocurrencies to accept as payment. With over 80 different currencies available, merchants have the flexibility to select the specific currencies they wish to accept, whether it’s just one or all of them. Some of the most well-known cryptocurrencies available on FCF Pay include Bitcoin, Ethereum and USDT as shown below.

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- BNB

- USD Coin (USDC)

- Binance USD (BUSD)

- Ripple (XRP)

- Dogecoin (DOGE)

- Cardano (ADA)

- Solana (SOL)

Ease of setup

Integrating FCF Pay into an e-commerce platform is easy with pre-built integrations and detailed documentation. FCF Pay offers integrations for popular platforms such as:

- Woocommerce

- Magento

- Prestashop

- Shopify (coming soon)

Alternatively, merchants can use FCF Pay’s API connection to integrate the platform into their e-commerce store. Detailed documentation is provided for both options, and the FCF Pay team is available to assist merchants with the integration process.

Safety

FCF Pay uses a secure checkout page for completing crypto payments, with options for customers to scan a QR code or copy a wallet address. This method is considered the safest way to complete crypto payments.

In addition to the secure checkout page, FCF Pay’s system is built on an industry-standard, fully encrypted multichain cryptocurrency vault. This ensures the safety of both merchant and customer funds. The vault is the same type used by major cryptocurrency exchanges and is highly secure.

Overall, FCF Pay’s focus on security makes it a reliable and trustworthy choice for merchants and customers looking to complete crypto payments. By using a secure checkout page and an encrypted vault, FCF Pay ensures that transactions are completed safely and securely.

White-label solutions

FCF Pay’s white-label solution offers a range of benefits to merchants and payment service providers (PSPs) looking to accept cryptocurrencies as payment and is our best rated white-label crypto payment gateway. By using the white-label solution, businesses can rebrand the payment gateway as their own product, saving them significant time and resources. For a comprehensive overview of white-label crypto payment gateways and to see which other white-label providers exist, we recommend visiting our analysis of the best white-label crypto payment gateways. This resource provides detailed information on a range of white-label providers, as well as insights and rankings to help you make an informed decision.

In addition to its core payment platform, FCF Pay also offers a white-label version of their crypto credit cards to merchants, exchanges, banks, and other partners. This product allows businesses to offer a branded version of FCF Pay’s crypto credit cards to their customers, providing a convenient and secure way to make purchases and manage their cryptocurrencies.

FCF Pay’s crypto credit cards come in two versions: a minimal KYC version with a daily limit of up to $10,000, and a higher-limit version with a daily limit of up to $175,000, which requires ID verification. These limits give businesses the flexibility to choose the version that best meets their needs, while also ensuring the security of the payment process.

The white-label crypto credit cards offer a range of benefits for businesses, including the ability to customize the look and feel of the cards to align with their branding, and offer a convenient and secure payment option to their customers. By using the white-label version of FCF Pay’s crypto credit cards, businesses can differentiate themselves in the market and provide a unique and branded payment experience to their customers. Whether it’s an online or offline store, a PSP, or a financial institution, the white-label crypto credit cards can be used by a wide range of businesses looking to offer a customized payment experience.

Overall, FCF Pay’s white-label solution is a valuable feature for businesses looking to streamline their payment process, save time and resources, and differentiate themselves in the market. By using the white-label solution, businesses can focus on growing their business and providing a memorable payment experience for their customers.

How to create an account on FCF Pay

Step 2: You will receive a mail from FCF Pay. Open the mail and click the ‘Verify email address’ button.

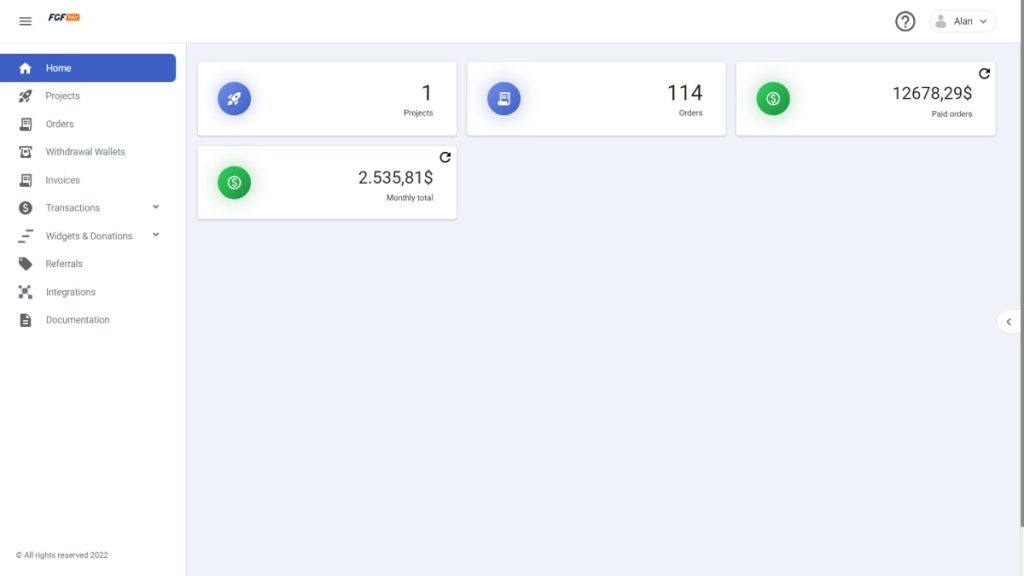

Step 3: Your account is now created and you can login on the website. After logging in, you will automatically visit the dashboard.

Step 4: Selecting which cryptocurrencies to accept. We highly recommend you to go to your profile settings by clicking on your name in the top right and thereafter on ‘profile’. A new page opens where you can click on a pencil icon right next to your name. A new page appears where you can select all the cryptocurrencies that you would like to accept in your store.

Step 5: Start accepting cryptocurrencies by choosing one of the integrations available.

Frequently asked questions

FAQ: Crypto payment gateway

FCF Pay is a cryptocurrency payment gateway that aims to simplify the process of accepting cryptocurrencies. It offers low transaction fees, and a range of smart functionalities to enhance the payment experience for businesses and individuals.

Yes, FCF Pay is considered safe and legit. The platform uses a secure checkout page and an encrypted multichain cryptocurrency vault, similar to those used by major cryptocurrency exchanges. This ensures the safety of both merchant and customer funds.

To use FCF Pay, you need to create a merchant account on their website. Once registered, you can select the cryptocurrencies you wish to accept, integrate FCF Pay into your e-commerce platform or website using their pre-built integrations or API connection, and start accepting crypto payments from your customers.

FCF Pay works as a bridge between customers making crypto payments and merchants accepting those payments. When a customer chooses to pay with cryptocurrency, FCF Pay facilitates the transaction by securely processing the payment, converting the cryptocurrency to fiat or stablecoins if desired, and transferring the funds to the merchant’s designated account.

No, FCF Pay does not require KYC (Know Your Customer) verification in order to use their crypto payment gateway.

FCF Pay offers both virtual and physical debit cards that enable users to make purchases using their cryptocurrency funds. These debit cards provide a convenient and secure way to spend cryptocurrencies at any merchant that accepts debit or credit cards.

Virtual card

The virtual debit cards offered by FCF Pay are a popular choice among users as they have a limit of $10,000 and do not require KYC (Know Your Customer) verification. This means that users can obtain and start using the virtual debit cards without the need to go through a lengthy verification process. These virtual cards are available worldwide, allowing users from various countries to access and benefit from the features they offer. You can get your own FCF Pay virtual debit card here.

Physical card

For users who require a higher spending limit and are willing to undergo full KYC verification, FCF Pay also offers physical debit cards. These physical cards have a higher limit of $175,000, providing users with more flexibility for their transactions. The full KYC verification process ensures compliance with regulatory requirements and enhances security. These cards offer full customization options, allowing users to choose between plastic, metal, or carbon card materials for delivery. You can get your own FCF Pay physical card here.

Whether users opt for the virtual or physical debit cards, FCF Pay’s offerings provide a seamless integration between cryptocurrency and traditional payment systems, allowing users to easily spend their digital assets for their everyday needs.

Ordering an FCF Pay crypto debit card is a simple process that can be done through the FCF Pay website. However, the process varies depending on the type of card you are interested in:

Physical card

To obtain a physical FCF Pay card, you will need to complete the KYC (Know Your Customer) process on the FCF Pay website. Once your KYC verification is complete, you can order the physical card conveniently through the FCF Pay dashboard.

Virtual card

The FCF Pay virtual debit card offers a hassle-free solution without the requirement of full KYC verification. Ordering the virtual card is simple: just access the designated section below or use the FCF Pay virtual card widget. Once the order is submitted, the card will be promptly delivered to you by mail.